Return

Affordability Eases, Igniting Demand for Hardwood & Cabinets

The last few weeks have been largely centered around budgets for the Cascade mills for 2026. When working on budgets, it was essential to look for information that could accurately forecast prices for 2026. This evolved into an article that highlights key considerations for the upcoming year in new home construction, home sales, and remodeling activity.

As 2026 dawns, a “new era” emerges in housing, with affordability ticking up for the first time in years. Home prices are capped or declining amid buyer discounts up to $25,000, while incomes are slated to rise faster than inflation, and rates hover in the low 6% range. Compass economist Mike Simonsen calls it “the start of sustained improvement,” flipping the post-pandemic script to boost sales without price spikes.

This thaw should also directly fuel remodeling activity, projected to grow 1.8-4% next year, per HIRI (Home Improvement Research Institute), NAHB (National Association of Home Builders), and Zonda forecasts. NAHB eyes 4% gains after 2025’s 10% surge, accelerating to 6% in 2027. Aging boomers who are living five years longer via medical advances are slated to drive 800,000 extra “aging-in-place” upgrades, while tax cuts and rising disposable income (top 20% earners fuel 50% of spend) offset 30% recession risks.

Additionally, half of U.S. homes are 40 years old or older, exacerbating deferred maintenance projects. Houzz’s 2026 Renovation Plans Report signals resilience: 91% of homeowners plan to proceed with their projects, with 67% expanding their scope despite cost hikes (63% cite materials as the primary reason).

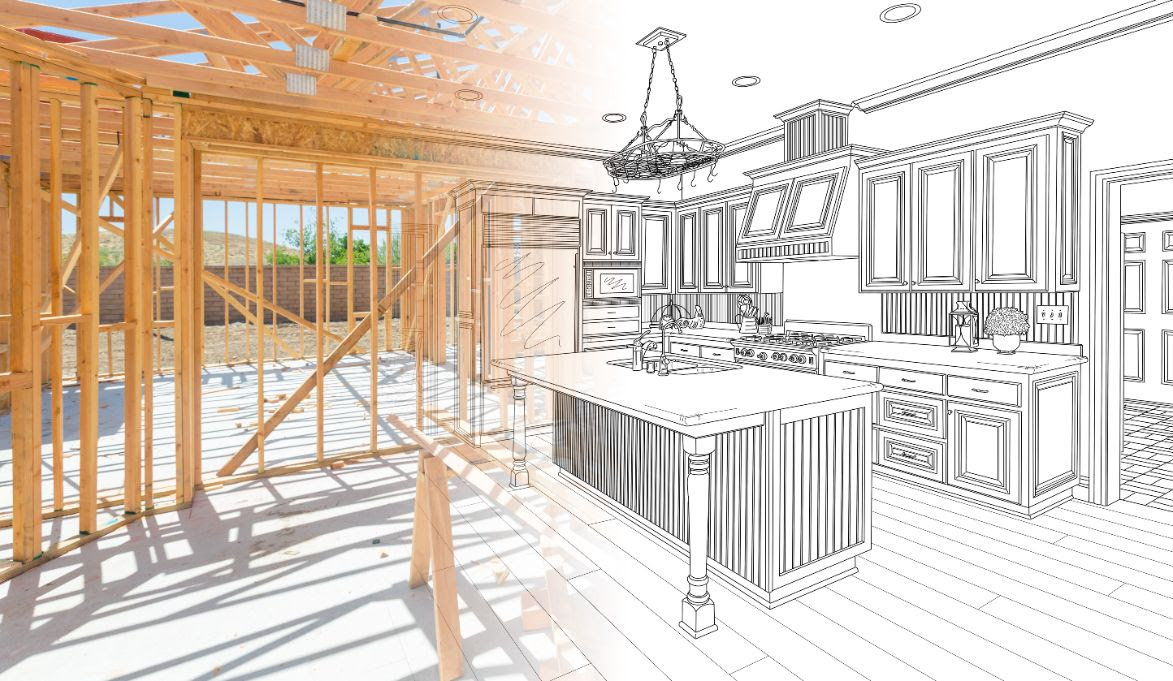

Kitchens lead the way, with traditional styles up 5%, embracing inset cabinetry, arched hoods, and richly stained woods for a handcrafted charm. Flat-panel/slab-front cabinets, which are now second to Shaker doors, are forecasted to gain traction in transitional spaces, paired with warm wood species and matte finishes. I saw firsthand at one of our cabinet door customers last week that this trend is continuing, with nice increases in volumes centered around solid inset panel doors that require the use of solid wood to accommodate panel edge details. This trend should bode well for Alder demand in the years to come. For hardwood lumber and cabinet makers, this spells opportunity: surging demand for premium woods in kitchens/baths, aging retrofits, and equity-fueled flips. With home equity outpacing debt since 2012, the outlook appears positive for 2026 and 2027. 2026 will not be a boom; most believe it will simply be the start of a very welcome steady climb.