Return

While Efforts to Return Manufacturing Are Lauded, Tariffs Create Cliffs for Lumber Manufacturers

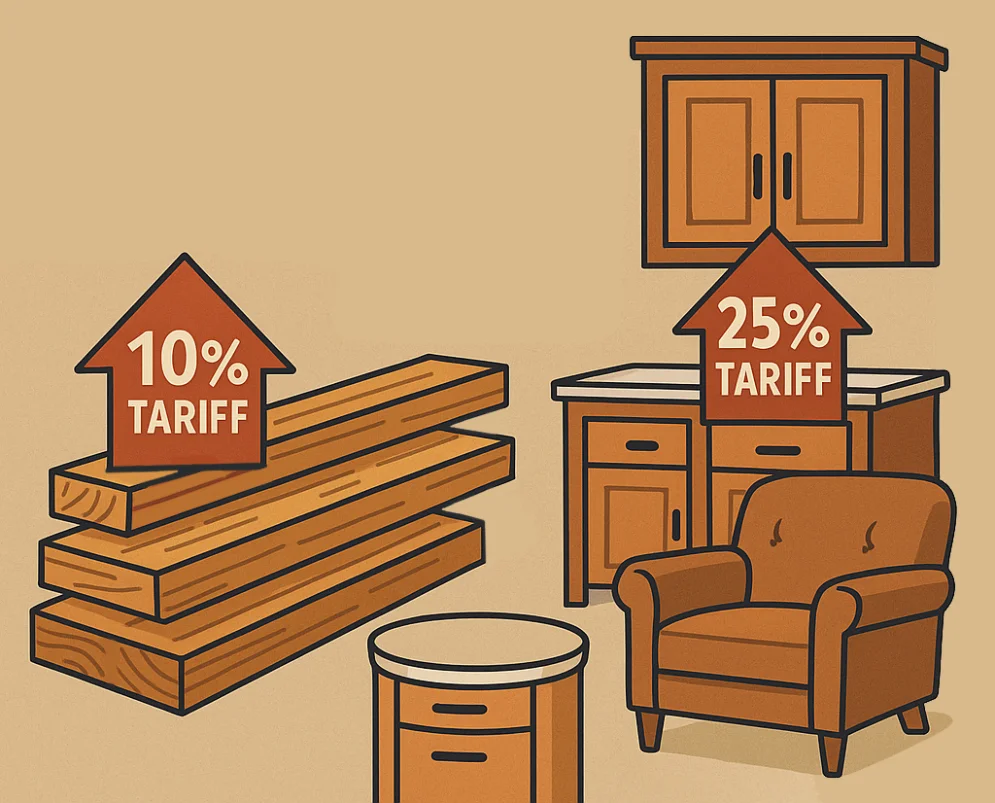

President Donald Trump said on Monday he was slapping 10% tariffs on imported timber and lumber and 25% duties on kitchen cabinets, bathroom vanities and upholstered furniture. The new tariffs target many of the countries Cascade and other hardwood manufacturers depend on to move a sizable part of the grades not normally consumed domestically.

Trump signed a presidential proclamation, which laid out his argument that timber, lumber and furniture imports are eroding U.S. national security to justify the new duties under Section 232 of the Trade Act of 1974.

Continuing use of Section 232 by the administration comes as he awaits a Supreme Court ruling on the legality of his broader “reciprocal” tariffs on global trading partners, which two lower courts have struck down. The use of Section 232 comes right behind a recently announced Section 232 investigation into imported hardwood plywood, and the products made from it like multi-layer engineered flooring.

The proclamation said the tariff rates would start on October 14 but added that duties would increase on January 1 to 30% for upholstered wooden products and 50% for kitchen cabinets and vanities imported from countries that did not reach an agreement with the United States.

Trump’s proclamation said wood product imports were weakening the U.S. economy, resulting in the persistent threat of closures of wood mills and disruptions of wood product supply chains, and diminishing utilization of the U.S. domestic wood industry.

“Because of the state of the United States wood industry, the United States may be unable to meet demands for wood products that are crucial to the national defense and critical infrastructure,” the statement said.

The order added that wood products were used for “building infrastructure for operational testing, housing and storage for personnel and material, transporting munitions, as an ingredient in munitions, and as a component in missile-defense systems and thermal-protection systems for nuclear-reentry vehicles.”

While the move is a laudable attempt to bring manufacturing back to the US, the small amount of material that would fall under a national defense claim seems almost insignificant. How many Spruce trees does it take to make nose cones to protect nuclear re-entry vehicles when there is no current production?

For Cascade, and all our other competitors in Alder and in Eastern hardwoods, this will hurt. Mills need markets for low-grade cut up grades and it will take time for manufacturers to return production to the USA. Manufacturers must be sure capital spent today will not be wasted with a change in tariff policy next month, next year or by the next administration. New plants and machinery can take two years to build, and a lot of the equipment to make things like cabinetry comes from Germany, Italy, Taiwan, and China, all under significant tariffs. So, if the value of this part of the production falls due to tariffs, margins to survive must come from other products. Will upper grade lumber increase in price? Will more mills succumb to the financial realities of sawmilling today? State-of-the-art upholstery manufacturers in Mexico have opened and will likely pick up some of the loss from overseas, but their turn-up capacity may be limited (there is some question if the new tariffs will apply to Mexico, or whether a revised USMCA USA Mexico Canada agreement would address these markets.) All these are challenging questions that will have broad reaching impacts on North American hardwood manufacturers.

At Cascade we have positioned ourselves better than most on reliance on overseas markets, but we do still have some exposure to Asia. Like other challenges, we will deal with this one by looking at what we are manufacturing, alternative options, and innovative ideas while making sure our committed base of North American distributors and manufacturers have all the Alder they count on (and hopefully more).